The Great VMware Migration And Beyond

Why NTNX represents one of the durable, profitable multi-year growth stories in enterprise software, even if Q4 gets bumpy

Sometimes the biggest opportunities in enterprise software don’t come from technological breakthroughs—they come from sweeping corporate realignments that put financial outcomes ahead of customer relationships. Broadcom’s $61 billion acquisition of VMware is a case in point: a once-stable incumbent now risks alienating its customer base through aggressive pricing and policy shifts designed to maximize near-term cash generation at the expense of long-term trust.

I think Nutanix is positioned as the primary beneficiary of what may be the largest customer migration in virtualization history. But this isn't just a growth story—it's a profitable growth story with multiple, layered drivers, beyond the VMware opportunity, that should compound over the next 2-3 years.

Here's why I'm increasingly bullish on NTNX as one of the most durable investment themes in enterprise software:

The VMware Displacement Opportunity

Since Broadcom closed its $61 billion VMware acquisition in November 2023, the fallout has been swift.

Transitioned away from vSphere only (standalone hypervisor), perpetual licenses, to broader subscription bundles that includes products that customers might not be interested in.

Price increases of 2x to 20x across customer segments, primarily as a result of bundling.

De-emphasizing VMware Tanzu and thus retreating from the Kubernetes/container platform market, which is quickly emerging as the foundation for modern, cloud-native application infrastructure.

Effectively ended the VMware Cloud on AWS partnership, terminating on-demand server provisioning

A 72-core minimum purchase requirement that penalizes smaller deployments. The result? A systematic exodus that's only just beginning.

Getting rid of the prior VMware channel program and downsizing the overall size

Quantifying the VMware Displacement Opportunity

The obvious question is: how big is this opportunity really? I think about it in two ways—either bottom-up by looking at potential customer counts, or top-down by examining VMware's addressable revenue.

Bottom-Up Analysis

When VMware was acquired, they served roughly 300,000 customers. Broadcom has clearly indicated they intend to focus on the top 2,000 strategic accounts, and to a large extent, the top 10,000 who comprise the bulk of VMware's revenue—effectively disenfranchising hundreds of thousands of smaller customers.

We're already seeing this impact Nutanix's logo growth over the last four quarters, jumping from 400-500 customer additions per quarter to 600-700 starting in Q4 FY24. Cumulatively, in the six quarters since the deal closed (from Feb 2024), Nutanix has added 3,120 customers representing roughly $150 million in ARR (assuming 100% came from VMware replacements, which may overstate it).

Even if we conservatively assume there are 100,000 disenfranchised customers to target (since many of the 300K were likely one-off VMC or EUC customers), and Nutanix captures 50% of them—though I think it could be closer to 70%—that represents a $5 billion total opportunity based on Nutanix's ~$50K average ACV for new customers, or $2.5 billion for Nutanix's 50% share.

But here's the kicker: even within Broadcom's top 10,000 strategic VMware customers, many are exploring dual-vendor strategies to de-risk against future price increases. The earnings calls reveal this is already happening, with large customers initially seeking Nutanix as a "second vendor alternative" before ultimately choosing to replace their entire incumbent supplier. This means the serviceable addressable market is likely much bigger than the prior estimate.

Here are some quotes from Nutanix earnings calls in the last several quarters highlighting some of the larger customer wins.

"A great example is a new logo and our largest land-and-expand win of the quarter with a Fortune Global 500 provider of technology and services based in the EMEA region. Our 2-plus year engagement with this customer was catalyzed by their concerns regarding the proposed acquisition of their incumbent infrastructure supplier, which were realized subsequent to the close of that transaction. This new customer was initially looking at Nutanix as a second vendor alternative, but saw the value of the Nutanix Cloud Platform as a way to modernize their existing infrastructure and ultimately chose Nutanix to replace their entire incumbent supplier over time."- Q3 FY25 (Apr) | May 2025

“One of these wins was a new logo with a North American-based Global 2000 energy technology company, which was motivated to seek alternatives due to a 200% price increase from their incumbent vendor.” - Q2 FY25 (Jan) |February 2025

“Another significant win in the quarter was an expansion with a Global 2000 provider of IT consulting services based in the APJ region. Not happy with the changes they had experienced with their other incumbent infrastructure vendor, this customer decided to transition the portion of their estate served by this other vendor to the Nutanix Cloud Platform, enabling them to improve their total cost of ownership while also addressing their concerns about pricing and support.”- Q2 FY25 (Jan) | February 2025

“Our largest new customer win of the quarter was an 8-figure ACV deal with a North American-based Fortune 50 financial services company that was looking to streamline and automate the deployment and management of their substantial fleet of databases.” - Q3 FY24 Earnings Call | May 2024

Top-Down Analysis

In terms of a tops down view, I estimate VMware’s business that Nutanix can go after is likely roughly around $10B in total.

When VMware was acquired, LTM revenue was roughly $13B of which 50% was compute and management, lets call it $7B.

Then, NSX (virtual networking, Nutanix has Flow) and vSAN (virtual storage) was probably about $2-3B, making up for the $10B number.

Rest of VMware had End-user computing, CarbonBlack and Pivotal etc. some of which are likely serviceable by Nutanix at this point, in addition to Professional Services.

Using a conservative 80/20 split between strategic and long-tail customers, and assuming a 50% win rate for Nutanix among long-tail customers, that's $1B in opportunity. For strategic customers, even a modest 15% dual-sourcing penetration (since no other vendor can seamlessly migrate VMware workloads) represents another $1B+ opportunity, thus leading to a conservative SAM of over $2B (not assuming any growth).

In other words, using both bottoms-up and top-down analysis, and conservative numbers, one can get to Nutanix potentially doubling its current scale, based on only the VMware opportunity.

Who are the Alternatives Eyeing This Opportunity

The alternative is largely refactoring the code to be container based (vs VM based) and moving directly to any of the hyper scaler Kubernetes platforms or RedHat OpenShift. Red Hat does have a VM-based solution, but my understanding is that it's not enterprise-class. One point (discussed later) is that Nutanix now has a very mature Kubernetes platform as well and can be part of the discussion to modernize the workload, in addition to it working with the hyperscalers to provide a common plane. There are some small players as well like Scale Computing, which is stronger in the SMB segment.

If it is Such a Big Opportunity, Why Is It Not Happening Faster?

There are a couple of nuances to this opportunity which is important to understand.

1) VMware is a fundamental piece of infrastructure and is deeply entrenched - like the foundation of a building with everything built on top. As such, it is not an easy lift and shift, especially for very large organizations.

Nutanix has made a lot of tools to make the migration easier, especially if it is only a hypervisor replacement (VMware to Nutanix). But it becomes more time consuming if the company is using virtualized storage or virtual networking along with the hypervisor.

Migration timelines largely depend on the size of the VM footprint—the larger the environment, the longer the migration process. For example, one company with 24,000 VMs required a full year to complete their migration from VMware to Nutanix. Depending on workload complexity and organizational scale, migration timeframes can range from several weeks for smaller deployments to multiple months or even years for enterprise-scale environments.

2) Nutanix's primary market has been hyperconverged infrastructure (HCI), where they hold over 50% market share. VMware, however, dominated the much larger server virtualization market built on traditional 3-tier architectures—separate compute, storage, and networking hardware.

This creates three migration paths for VMware customers:

1) Wait for hardware refresh cycles and move to HCI (cheaper to operate but requires timing alignment)

2) Wait for Nutanix to support the different hardware platforms with a standalone hypervisor to replace VMware while keeping existing hardware.

3) Completely redesign applications for containerized, Kubernetes-based deployment.

Nutanix's Strategic Response For the first time in its history, Nutanix has partnered with Dell PowerFlex storage and launched a standalone hypervisor (GA since April 2025) to capture opportunities faster without forcing hardware changes. They're also working with Pure Storage on a similar offering expected by end of 2025.

As Nutanix supports more of the hardware, they will be able to get customers to move away from VMware faster without having to abandon their hardware investments. At the same time, it’s a delicate balance for Nutanix, as this might delay the customers move away from 3-tier into HCI, which is the end-game.

Key Takeaway: VMware Opportunity Will Unfold Over Multiple Years

While the VMware displacement opportunity is significant, the migration complexity and architectural considerations mean this will unfold over multiple years rather than quarters.

Beyond VMware: Building a Durable Platform Business

Innovation Beyond VMware: The Kubernetes and Hybrid Multi-Cloud Play

While the VMware replacement opportunity story likely captures all the attention, Nutanix is quietly driving organic and inorganic innovation positioning for the future of enterprise workloads.

Nutanix's Cloud-Native AOS solution, announced in Q3 2025, enables modern applications to leverage enterprise-grade storage and data services whether running in public clouds, native Kubernetes environments, or bare metal. This capability was significantly enhanced through Nutanix's acquisition of D2iQ's assets (formerly Mesosphere) in late 2023, bringing proven Kubernetes management technology including the D2iQ Kubernetes Platform (DKP) and DC/OS expertise that had been battle-tested in enterprise environments for over a decade.

This isn't just feature parity with VMware—it's leapfrogging into cloud-native territory that VMware has retreated from following Broadcom's acquisition. More importantly, Nutanix's unified control plane across Azure and AWS delivers what enterprises have been seeking: seamless management and governance across hybrid environments without the complexity of juggling multiple vendor toolsets.

Former Rivals Transform Into Strategic Alliance Partners

The shift from competition to collaboration is perhaps most evident in Nutanix's transformation of relationships with traditional infrastructure giants Cisco, Dell, and HPE—companies that were once fierce competitors now working as strategic partners.

Cisco's "360-degree partnership" with Nutanix, announced in August 2023, goes far beyond traditional reseller agreements, spanning "strategy, engineering, support/services, and go-to-market" as Cisco discontinued its competing HyperFlex platform.

Dell's relationship with Nutanix has come full circle. While Dell was a champion of Nutanix in the early days, that relationship faded somewhat when Dell acquired VMware via its purchase of EMC in 2016. The companies announced renewed collaboration at .NEXT 2024, integrating Dell PowerFlex as "the first external storage integrated with Nutanix Cloud Platform."

Similarly, HPE has embraced partnership through HPE GreenLake with Nutanix, offering "HPE ProLiant DX servers optimized for Nutanix" with consumption-based pricing models.

This collaborative approach reflects a fundamental market shift—rather than building competing hyperconverged solutions, these infrastructure leaders now recognize that partnering with Nutanix's software-defined platform allows them to focus on their hardware strengths while addressing the post-VMware disruption and AI infrastructure demands driving customer modernization priorities.

The AI Opportunity

As enterprises accelerate AI deployment from experimentation to production at scale, the need for secure, cost-effective AI infrastructure is driving unprecedented demand for on-premises solutions. Nutanix's GPT in a Box 2.0 leverages partnerships with NVIDIA NIM and Hugging Face to deliver "a turnkey GPT solution that is quick to build, easy to support, and has very low TCO" while ensuring "the data you're providing remains on-premises" to prevent AI model contamination.

This positions Nutanix perfectly to capture the enterprise AI boom, with early wins already demonstrating market traction.

“We believe the Nutanix Cloud Platform, including Nutanix Kubernetes Platform and Nutanix Enterprise AI or NAI is well suited to helping enterprises quickly and efficiently deploy and run their GenAI applications on real-life use cases, wherever their data resides. As one example, in Q2, a financial services provider in the EMEA region adopted our Nutanix Enterprise AI platform to deploy their internal GenAI applications, which include multilingual translation and a multilingual chatbot. NAI will enable them to deploy their GenAI apps on their existing Nutanix Cloud Platform while benefiting from the automation NAI provides in scaling and running of inferencing endpoints for large language models”. - Q2 FY25 (Jan 2025) | February 2025

The Renewals Waterfall: Growth Air Cover and Operating Leverage

An important but perhaps most forgotten part of the story is the ongoing renewals waterfall, which not only provides some growth air-cover but also acts as a big driver of ongoing operating leverage.

Since Nutanix began transitioning to subscriptions starting from January 2019 (3QFY19), renewals have steadily grown as a percentage of total billings—from over 30% in FY23 (July) to 40% in FY24 (July), with this mix naturally edging toward 70-75% over the next few years as the installed base matures. Every dollar of renewal revenue is fundamentally more profitable than new logo acquisition. No sales commissions, no lengthy proof-of-concepts, no competitive bake-offs—just natural expansion within the existing base. This provides both air cover for any quarterly volatility and a mathematical path to margin expansion as the higher-margin renewal revenue increasingly dominates the billing mix. Additionally, the expansion math has some correlation to natural workload growth for existing customers on the same use case, in addition to adding new use cases to the platform or adding new platform capabilities.

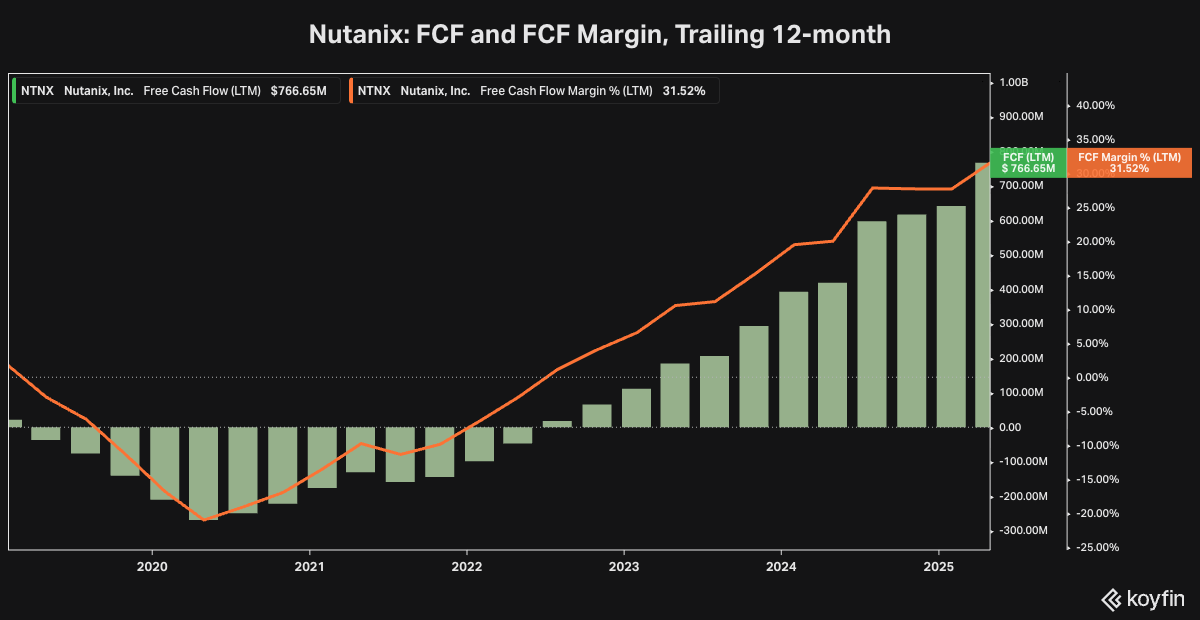

This growing operating leverage is best visible in the FCF story for Nutanix. As shown in the image below, Free cash flow has exploded from barely positive territory in 2021 to over $765 million on a trailing twelve-month basis, with FCF margins expanding to over 31%. This isn't just revenue growth—it's profitable revenue growth with expanding returns on capital.

The subscription transition and renewals mix improvement is showing up directly in these cash flow metrics, validating the thesis that this business model naturally drives operating leverage over time.

The FQ4 Tactical Headwinds

While I remain highly constructive on Nutanix as a long-term, durable profitable growth compounder—with multiple structural tailwinds that should drive sustainable expansion over the next 2-3 years—the near-term setup heading into Q4 is admittedly tricky and worth acknowledging for tactical positioning:

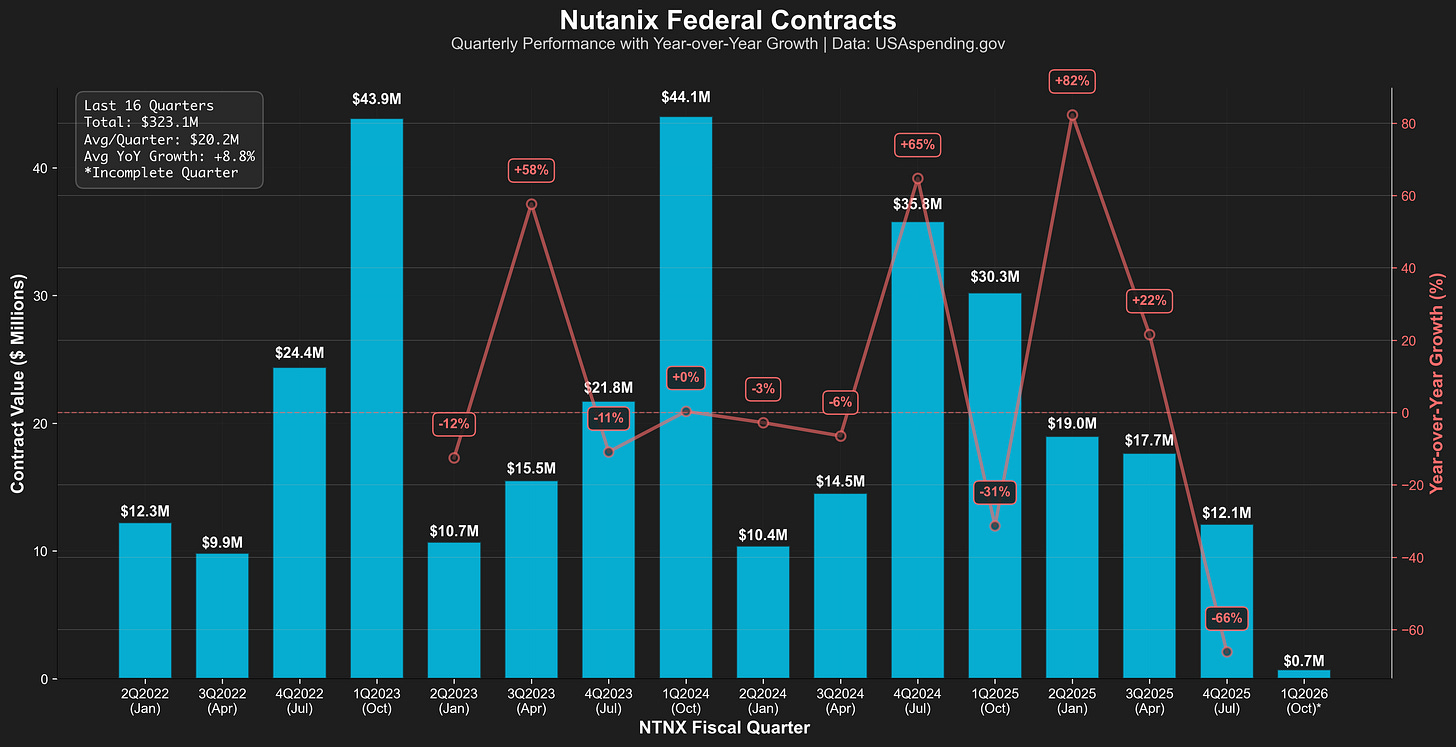

US Federal Performance: A Source of Near-Term Caution

The US Federal business provides a cautionary tale for the near-term outlook, as shown in the image below. After a muted start to the year for the October quarter, US Federal did bounce back in the January quarter, but the growth has deteriorated since then, with 4Q marking a new low in the last three years. While the federal segment represents less than 10% of total revenue, the continued muted performance despite having "a good pipeline of opportunities" in the federal space is slightly concerning and could likely weigh on the FY and the 1Q guide, with the latter being the biggest Federal quarter for the company.

Guidance Setup is a bit Tricky, Tactically Speaking

Q4 will provide the first full-year FY26 guidance, and current consensus projections might prove challenging to outperform, especially with respect to revenue.

Street expectations are calling for ~15.5% y/y revenue growth, implying roughly $393 million in net new revenue additions (vs. current consensus for FY25). Even if Nutanix beats Q4 by the typical $13 million (average of the last 8 quarters), that would suggest +2% growth in net new revenue year-over-year to achieve the consensus numbers.

Given what appears to be a muted US federal performance, the current muted macro environment and pipeline that is more weighted to large deals with more variability in close rates, I expect the company to guide conservatively.

Last year the company started the year with a net-new revenue growth down 16%. I think this year, the company might guide 5% to 10% decline in net-new revenue, which would roughly equate to 14-15%, with a higher likelihood to be closer to or just below 14% growth.

Profitability wise, it is important to understand that FY26 will not have the R&D expense benefit the company received last year ($20-25M or less than a point of headwind). Additionally, Nutanix will be layering in a bigger base of headcount in FY26. As such the initial guide for EBIT margin, could land below as consensus is expecting a point of margin expansion.

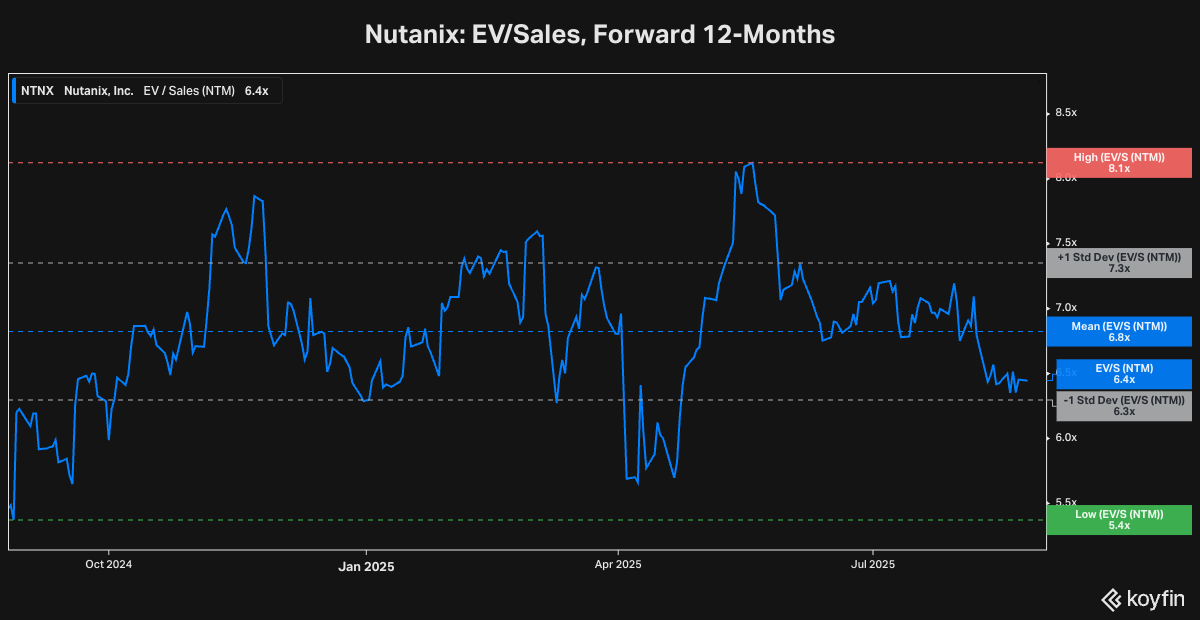

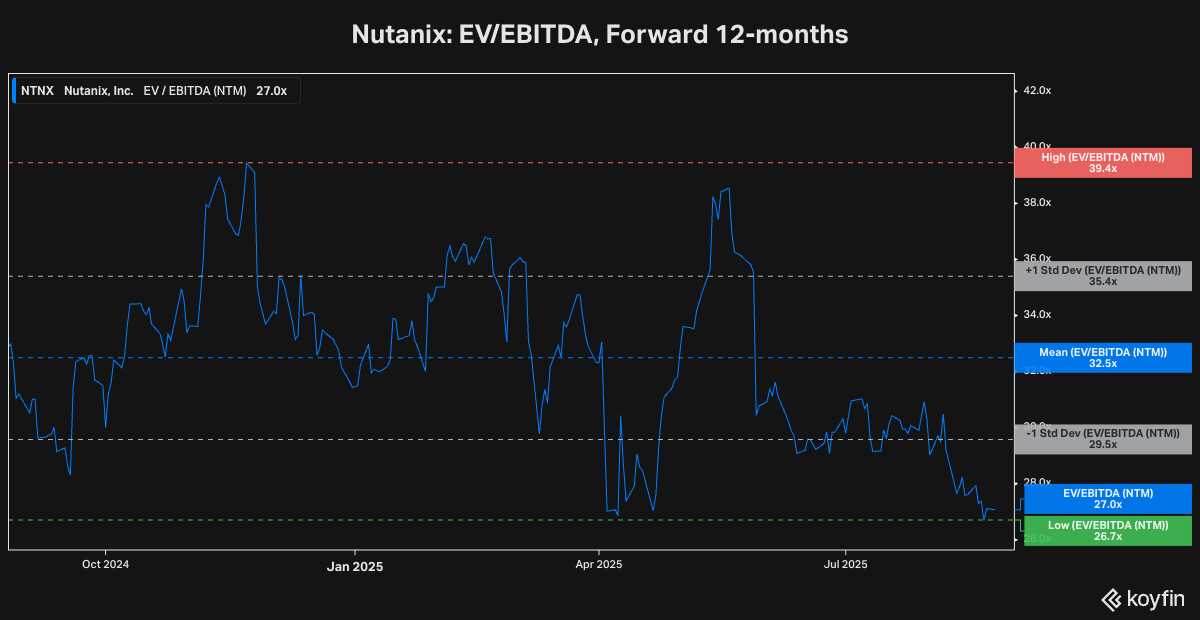

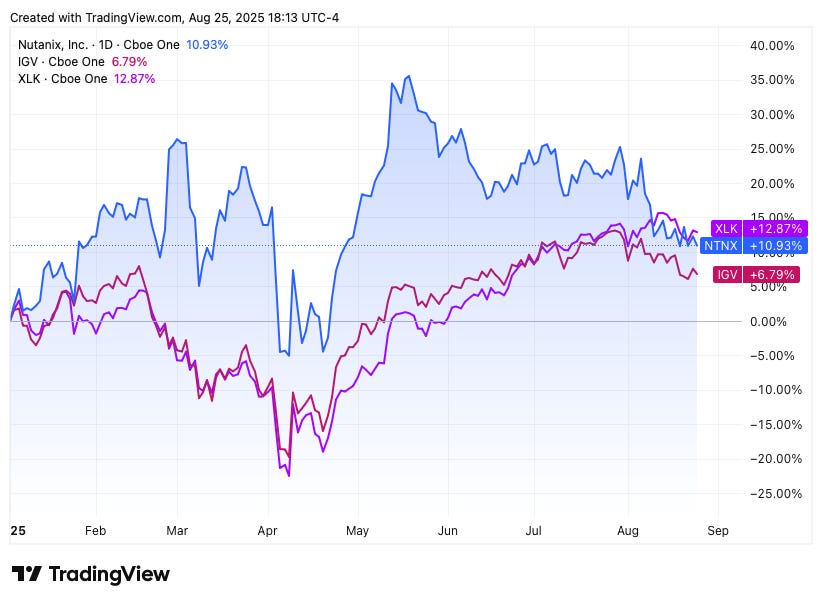

The tricky part is to figure out the stock reaction given that the stock is already down 10% from the levels after last quarter and is trading at modest valuation levels, as shown in the images below, although that doesn’t mean that it cannot fall further.

The Bottom Line

Nutanix represents a rare convergence of structural growth drivers and improving unit economics, wrapped in a story that should compound over multiple years rather than quarters.

The VMware displacement opportunity alone provides a multi-billion dollar runway, while the company's evolution into a true hybrid multi-cloud platform positions them to capture workloads far beyond traditional virtualization.

Yes, the Q4 setup is tricky, and there is a chance that FY26 guidance may disappoint relative to current expectations. But that's precisely what creates attractive entry points for durable, long-term themes. The subscription model transformation is mathematically driving margin expansion, the competitive moat is widening as enterprises seek VMware alternatives, and the pipeline of displacement opportunities continues to build.

For investors willing to look past near-term volatility, Nutanix offers something increasingly rare: a clear path to sustained, profitable growth driven by structural industry shifts rather than cyclical tailwinds. The key is having the patience to let the story play out over years, not quarters.

The best investments often require tolerating short-term uncertainty to capture long-term value creation. In Nutanix’s case, that uncertainty feels manageable relative to the opportunity.

As Tom Petty sang, “The waiting is the hardest part.” But for those willing to wait, Nutanix appears well positioned to deliver a performance worth the patience.