Quick Take: Elastic Setup Looks Interesting Based Purely on Monkey Math

Conservative guidance could be setting up for beat-and-raise cadence

Diverging from my usual pattern of writing a thoughtful deep dive on fundamentals (because who has time for that when there's monkey math to be done?), I thought I'd write something more tactical. I know there's some angst around ESTC 0.00%↑ among investors , but I wanted to highlight the FQ1(July) setup based on some tactical observations around the numbers.

The Sandbag Theory

Looking at Elastic's FQ1 (Jul) guidance, something interesting caught my eye. The revenue guidance actually imply their first-ever negative sequential growth on a days-adjusted basis. That's... never happened before.

Here's the thing: in the last two Q1 periods, Elastic has been pretty consistent with days-adjusted sequential total revenue growth sitting around +1.5%. But their current revenue guidance implies -1%. If they were to hit their normal sequential pattern instead, we're looking at a potential $10-11M beat.

This makes me wonder - could Elastic be building in a hefty ~$40M cushion into their revenue guidance to essentially "clean the slate" and kick off a fresh beat-and-raise cycle? The math actually works out pretty reasonably if you think about it that way.

Under this scenario, we'd be looking at roughly 17-18% revenue growth for subscriptions (less monthly cloud) and only 6-7% net-new growth. While that might sound modest for Elastic, it's not exactly outrageous - they posted 8% growth last year and 3% the year before. It also aligns with cRPO growth ending the year at 18% (17% in CC) last year.

Then again, since we're talking about total revenue guidance here, it does include the possibility of services revenue falling off a cliff, although not sure why that would happen.

While this theory makes sense with a new CFO potentially wanting to reset expectations and build investor trust, it's difficult to have full conviction given Elastic's history of expectations mismatches, which makes any conservative guidance thesis harder to embrace with confidence.

Other Supporting Data Points

A few other things working in their favor:

Cloud consumption trends look mostly robust across the hyperscalers as well as other companies, most recently highlighted by MDB.

“In Q2, Atlas consumption growth was strong and relatively consistent with last year's growth rates. This drove the acceleration in revenue as well as the growth in absolute revenue dollars year-to-date for the first half of fiscal 2026.” - MDB Earnings call, August 26th 2025

Hiring momentum is picking up - headcount growth appears to have accelerated to roughly +14% y/y in the three months ending July, up from +11% y/y through April. Additionally, sales hiring seems to be running at the 20% level.

While Elastic seems to be ramping up hiring, the competitive picture is mixed. Pinecone's headcount growth appears to be declining, and Weaviate is showing signs of deceleration (still growing fast, but from a much smaller base).

FX is getting friendlier - always nice when currency headwinds turn into tailwinds

Potential Headwinds to Consider

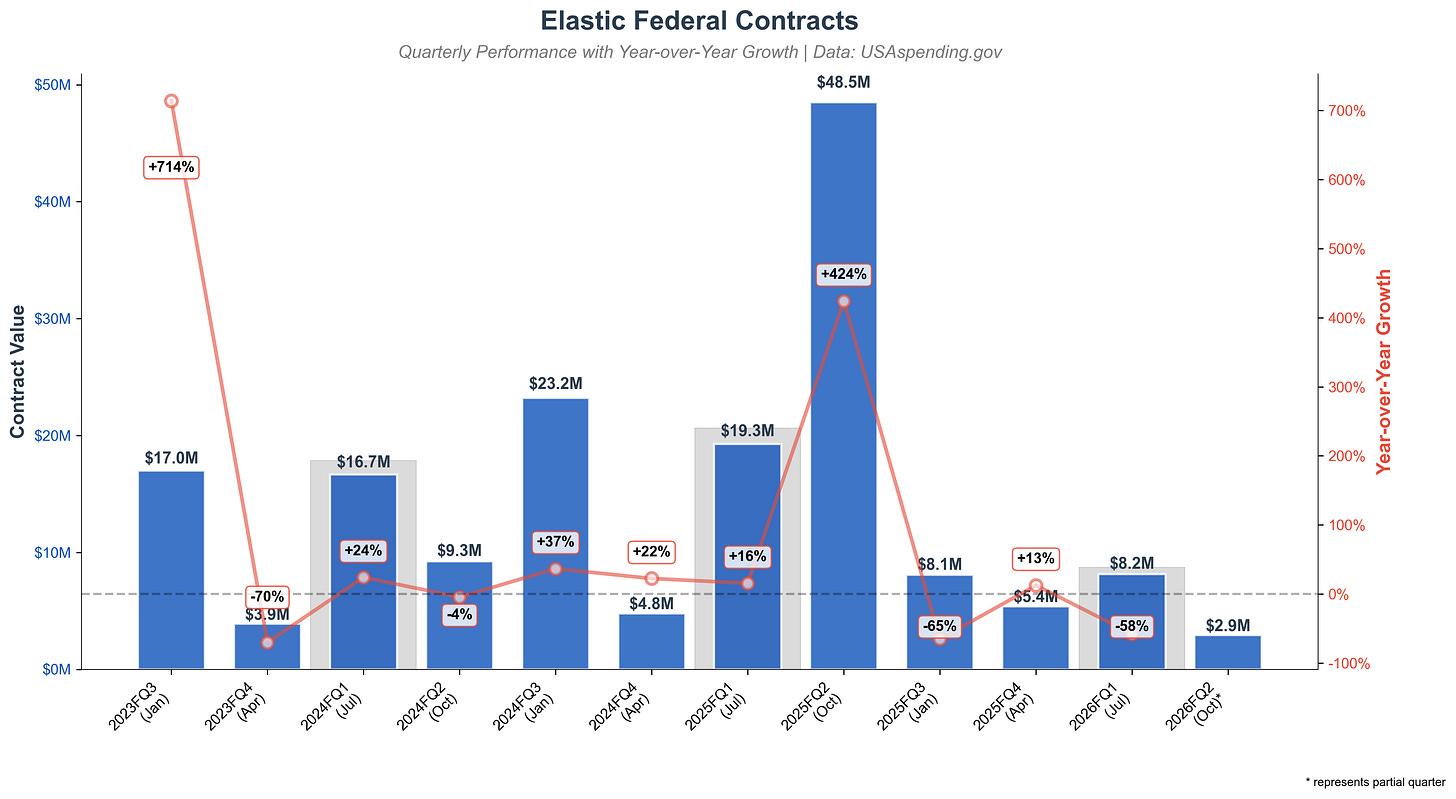

US Federal business looks pretty muted - similar to what we're seeing with NTNX and GTLB. Though to be fair, this isn't typically a big federal quarter anyway.

The pickup in hiring could weigh on near-term profitability, although that is likely already baked into the guide.

Bottom Line

The revenue guidance looks achievable based purely on the math, and a few supporting factors. With the stock trading very close to where it ended up after last quarter (<5x EV/FTM sales), any indication that the guidance bakes in a good cushion could help with the multiple. I guess, time will tell if this is strategic conservatism to build investor trust or just prudent guidance in uncertain times.

Worth noting: Elastic is heading into a new product cycle around Serverless, which could be a key catalyst to watch in the coming quarters.