Beyond Vector Databases: Elastic's Context Engineering Play

Key analyst day takeaways on agentic AI infrastructure, medium-term outlook, and capital allocation

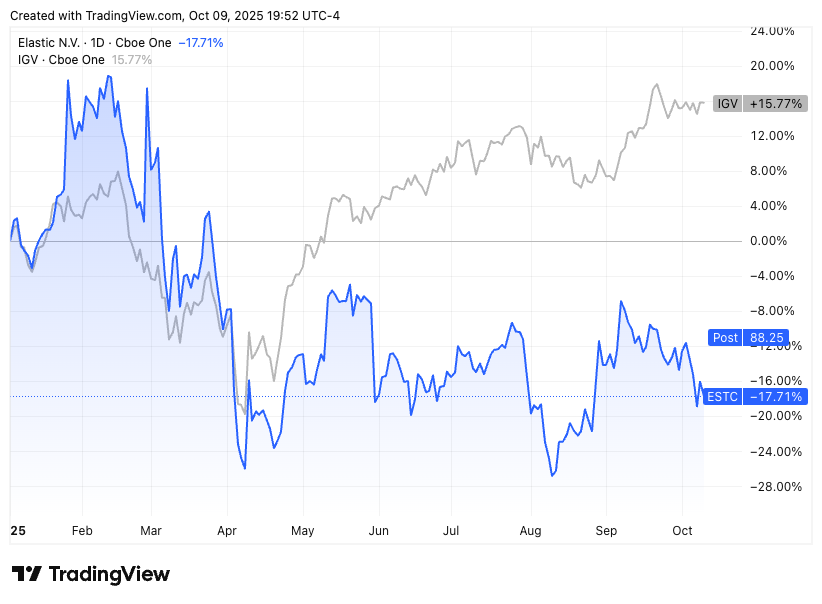

Three things stood out at Elastic’s analyst day: the breadth of their AI platform strategy, ambitious 20%+ medium-term targets, and their debut share buyback program. Together, they suggest a company hitting its stride.

Elastic as a Context Engineering Platform for Agentic AI Future

Elastic has been making significant inroads into vector search over the last several years, establishing itself as one of the leaders. I’ve recently written about Elastic’s vector database traction from a developer perspective, where GitHub data revealed them leading in development intensity (over 5K vector-related PRs year-to-date) signaling engineering investments few competitors can match.

But at today’s analyst day, the company repositioned itself in a way I hadn’t anticipated: Elastic is expanding beyond vector databases to become a full end-to-end context engineering platform, a capability that will become increasingly critical as Agentic AI workflows flourish.

Context engineering is the process of designing, structuring, and supplying the right information to an AI model so it can give the most accurate and useful response for a specific task….RAG is one component, but context engineering is the glue that makes your AI “situationally intelligent.” - from ChatGPT

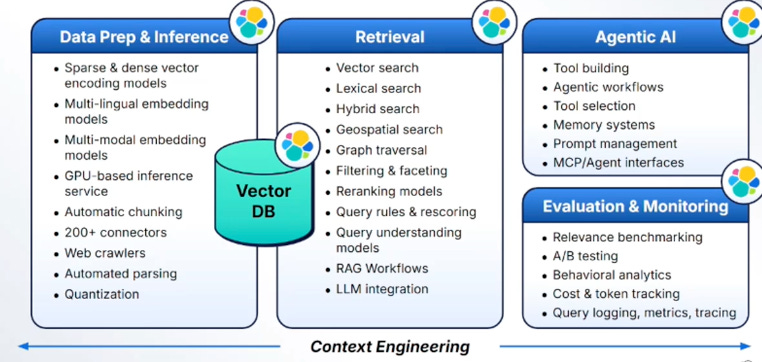

Here’s how I understand it: it’s the complete discipline of building the pipeline that gets the right information to AI models, involving several steps far beyond just storing and retrieving vectors (which is essentially what RAG is):

It encompasses data ingestion and chunking, creating embeddings, hybrid retrieval (combining vector search with lexical and other search techniques), reranking and evaluating results, and production monitoring

In the agentic era, context engineering also includes exposing data as tools (through MCP servers) that agents can intelligently select from, requiring prompt management, memory management, and tool selection frameworks

Essentially, it’s the entire engineering stack needed to make AI systems work with real-world knowledge

This slide made it clear how Elastic handles context engineering end-to-end::

Data ingestion through production: Elastic handles data ingestion from multiple sources (they already store documents, logs, metrics, security data for customers), applies chunking strategies, creates embeddings through their ELSER model or Elastic Inference Service (EIS), and performs hybrid retrieval by combining their native vector search with Elasticsearch’s powerful lexical search, plus filtering and geospatial capabilities. They provide reranking models and have built-in evaluation frameworks, query logging, and observability for production monitoring.

Agentic capabilities: Elastic announced Agent Builder, which exposes customer data as MCP (Model Context Protocol) tools that agents can intelligently select from. This includes prompt management, memory management for persistent agent context, and tool selection frameworks that help LLMs choose the right data sources, shifting from “pass context in the prompt” to “give agents the right tools.”

The platform play: Rather than forcing customers to stitch together multiple vendors for each piece, Elastic provides the entire context engineering stack in one platform, where the data already lives. This is their differentiation: integrated infrastructure from data storage through inference to agent orchestration.

Other things that caught my attention :

The company is building on its position through its acquisition of Jina AI, which brings research-grade models built for production. This not only augments its own sparse vector model ELSER by adding multi-lingual and multi-model capabilities, but also brings together a research organization known in the industry.

Elastic also announced a new inference service. It appears that Elastic Inference Service (EIS) is Elastic’s strategic move to own more of the AI infrastructure stack. Rather than forcing customers to patch together third-party inference APIs, Elastic is embedding GPU-accelerated models, embeddings, reranking, retrieval, directly into their cloud platform. The play here is integration: customers get inference where their data already lives, reducing latency, simplifying architecture, and creating stickiness. Elastic isn’t just providing search infrastructure anymore, they’re positioning themselves as the unified layer for the entire context engineering workflow. This reduces customer friction and, importantly, keeps them from needing to adopt competing solutions like Pinecone or standalone inference providers.

Elastic’s AI investments are showing up in the numbers. Gen AI customers are driving 6 points higher net expansion than non-Gen AI customers. With only 20% of Elastic’s customers spending $100K+ in ARR (and ~10% of total customers) using Gen AI capabilities , there is still a lot of whitespace to expand Gen AI across the broader base of large customers.

Mid-Term Target of 20%+ Growth for Sales-led Subscription Revenue

Elastic set a medium-term target of 20%+ growth for sales-led subscription revenue (excluding monthly cloud), roughly 3 years post-FY26. The target is built on 15%+ base growth plus a 5%+ tailwind from Gen AI. As the base gets larger, sustaining 20% growth becomes increasingly commendable, it’s not just about maintaining pace, but doing so at scale.

Overall, the framework seems reasonable given the underlying fundamentals. TTM net revenue retention for sales-led growth sits at 13% as of FY25, with even the oldest cohorts (FY13-FY20) still growing 10%. And as noted earlier, Gen AI customers are already driving 6 points higher expansion versus non-Gen AI customers. The GTM changes appear to be gaining traction, and the technology innovation is compelling.

While the medium-term framing offers directional confidence, I think it does leave some room for interpretation on the path to get there. With sales-led subscription revenue growing 20% in the July quarter, the target could signal sustained momentum or perhaps some near-term moderation (guidance implies ~17% for the year) before reaccelerating toward the goal.

A few details would have been helpful to clarify: whether the target assumes constant currency, how does pricing play a role as growth lever, and whether it’s purely organic growth. But overall, the framework suggests management confidence in their AI positioning and execution.

On profitability, Elastic also set a medium-term target of 20%+ operating margin, up from the 16.25% expected in FY26 (which management characterized as an investment year). The path seems plausible: product gross margins already exceed 80% on subscription revenue with room for further improvement, and the company has demonstrated S&M and G&A leverage over the past five years. The plan is to maintain discipline on OpEx after the FY26 investment cycle while driving subscription margin expansion, a familiar playbook for software companies at scale.

On near-term momentum, Elastic raised both Q2 (Oct) and FY26(Apr) guidance citing stronger-than-expected commitments. Full-year revenue growth moved up 100 basis points to 15% (from 14% prior). However, the footnotes indicated constant currency growth remains at 13%, which creates some confusion (unless I am missing something which can be possible) about whether the improvement is purely FX-driven or reflects underlying business strength, more clarity here would have been helpful. Worth noting: October could see significantly reduced federal spending given the ongoing government shutdown, creating a potential headwind for the fiscal second quarter. Elastic’s decision to raise guidance despite this macroeconomic uncertainty suggests underlying business momentum that offsets near-term federal procurement challenges

Elastic Launches First Buyback Program

Elastic announced its first share repurchase program: $500 million authorized, with over 50% expected to be deployed in FY26. Going forward, the company plans to return 50% of free cash flow to shareholders through buybacks, unless more attractive M&A opportunities arise (notably, they just closed the Jina AI acquisition).

This marks a maturation milestone for Elastic: the company is confident enough in its cash generation and growth trajectory to begin returning capital while still investing in strategic acquisitions. With the stock trading at roughly 4-5x EV/revenue, for a company growing in the high teens and generating 22% adjusted TTM free cash flow margins. I read this as management signaling they view current valuations as an attractive opportunity for capital deployment.

Elastic joins Monday.com in recently announcing a buyback program. With many software companies, particularly application software, trading at similarly compressed multiples despite strong cash generation, this could signal the beginning of a broader trend toward systematic buyback programs across the sector.

Bottom Line

Elastic’s technology evolution continues to impress me. The platform repositioning from vector search to integrated context engineering is well-timed for agentic AI workflows, and the strategic logic of owning the entire stack where customer data lives is compelling. However, it all comes down to execution. Investors have been wary of Elastic based on past stumbles, and the market has learned to demand proof over promises. That said, the company has delivered stable execution for several quarters now, and the early Gen AI traction is real. If Elastic can actually deliver on 20%+ revenue growth with 20%+ FCF margins through the next few years, the stock at 4-5x EV/revenue is undervalued. The opportunity is clear, the recent performance is encouraging, and the valuation provides a margin of safety.

Now it’s about converting skeptics through sustained execution.